What Is Ethereum’s Role in Smart Contracts?

Ethereum has become a cornerstone of blockchain technology, especially when it comes to enabling smart contracts. These self-executing agreements are transforming how transactions and digital interactions occur across various industries. Understanding Ethereum’s role in this ecosystem is essential for anyone interested in blockchain innovation, decentralized applications (dApps), or the future of digital finance.

How Ethereum Supports Smart Contracts

At its core, Ethereum provides a decentralized platform that allows developers to create and deploy smart contracts without relying on centralized authorities. Unlike traditional contracts that require intermediaries like lawyers or banks, smart contracts on Ethereum automatically execute predefined rules once certain conditions are met. This automation reduces costs, increases transparency, and minimizes the risk of manipulation.

Ethereum's blockchain acts as an immutable ledger where these contracts are stored and executed. Once deployed, they run exactly as programmed—no third-party intervention needed—ensuring trustless interactions between parties. This feature makes Ethereum particularly appealing for applications requiring high security and transparency.

Programming Languages Powering Smart Contracts

One of the key strengths of Ethereum is its support for specialized programming languages designed explicitly for writing smart contracts. Solidity is by far the most popular language used within the ecosystem; it resembles JavaScript in syntax but offers features tailored to blockchain development.

Developers can craft complex logic within their smart contracts using Solidity, enabling functionalities such as token creation (ERC-20 tokens), voting mechanisms, financial derivatives, or even gaming logic. The flexibility provided by these languages allows for innovative use cases across sectors like finance (DeFi), gaming (NFTs), supply chain management, and more.

Gas Fees: The Cost of Running Smart Contracts

Executing smart contracts on Ethereum isn’t free; it involves paying gas fees measured in Ether (ETH). Gas represents computational effort required to process transactions or contract executions on the network. When users initiate a transaction involving a smart contract—say transferring tokens or executing a DeFi trade—they must pay an amount proportional to the complexity involved.

This fee mechanism helps prevent spam attacks but also introduces considerations around cost efficiency during periods of high network congestion. Recent upgrades aim to optimize gas consumption while maintaining security standards—a critical factor influencing user adoption and developer activity.

Smart Contracts’ Role in Decentralized Applications

Smart contracts form the backbone of decentralized applications (dApps). These apps operate without central servers; instead, they rely entirely on code running securely on blockchains like Ethereum. From simple token swaps via platforms like Uniswap to complex lending protocols such as Aave or Compound—these dApps leverage smart contract logic extensively.

The ability to automate processes ensures that dApps can offer services with increased transparency and reduced reliance on intermediaries—a significant advantage over traditional centralized systems. As a result, industries ranging from finance to entertainment have embraced this technology for creating innovative solutions that prioritize user control over assets and data.

Security Challenges Associated With Smart Contracts

While offering numerous benefits—including automation and decentralization—smart contracts also pose security risks if not properly coded or audited. Bugs within contract code can lead to vulnerabilities exploitable by hackers; notable incidents include The DAO hack in 2016 which resulted in millions lost due to flawed code execution.

To mitigate these risks:

- Developers conduct thorough audits before deployment.

- Specialized firms provide security assessments.

- Formal verification methods are increasingly adopted.

Despite advancements in security practices, vulnerabilities remain possible due to human error or unforeseen edge cases within complex logic structures.

Scalability Issues And Upgrades Like Ethereum 2.0

As demand grows for dApps built atop Ethereum’s platform—including DeFi projects and NFTs—the network faces scalability challenges limiting transaction throughput and increasing fees during peak times. To address this:

- Ethereum 2.x aims at transitioning from proof-of-work (PoW) consensus mechanisms toward proof-of-stake (PoS).

- It introduces sharding techniques allowing parallel processing across multiple chains.

These upgrades promise faster transaction speeds with lower costs while enhancing overall network security—a crucial step toward mainstream adoption of blockchain-based solutions involving smart contracts.

Layer 2 Solutions Enhancing Performance

In addition to core upgrades:

- Layer 2 solutions such as Polygon (formerly Matic), Optimism, Arbitrum facilitate off-chain processing.

- They enable faster transactions at reduced costs by batching operations before settling them back onto mainnet.

These innovations help bridge current performance gaps until full-scale upgrades mature.

Regulatory Environment And Its Impact On Smart Contract Adoption

Legal frameworks surrounding blockchain technology continue evolving worldwide—and their influence directly affects how businesses develop with smart contracts on platforms like Ethereum:

- Governments seek clarity around issues such as securities classification for tokens created via smart contract protocols.

- Regulatory uncertainty may hinder innovation if overly restrictive policies emerge.

Conversely:

- Clear guidelines foster trust among users,

- Encourage institutional participation,

- Promote responsible development practices aligned with legal standards.

Importance Of Compliance And Auditing

Given potential legal implications:

- Regular audits ensure compliance with applicable regulations,

- Transparent documentation builds user confidence,3.. Collaboration between developers & regulators promotes sustainable growth.

Future Outlook: Risks And Opportunities

Despite impressive progress made through recent updates like ETH 2.x enhancements:

Risks remain, including:

- Security vulnerabilities leading potentially catastrophic losses,

- Regulatory uncertainties stalling broader adoption,

- Environmental concerns related mainly to energy-intensive proof-of-work models,

Opportunities abound through ongoing innovations:

1.. Continued scalability improvements will make dApps more accessible globally,2.. Growing sectors such as DeFi & NFTs expand use cases leveraging robust smart contract capabilities,3.. Increasing regulatory clarity could accelerate institutional involvement,

By balancing technological advancements with rigorous security measures—and aligning developments with evolving legal landscapes—Ethereum continues shaping its pivotal role at the heart of modern decentralized ecosystems.

Understanding how Ethereum supports intelligent automation through secure & scalable infrastructure reveals why it's considered foundational within blockchain technology today—and why ongoing developments will determine its future trajectory amidst emerging challenges & opportunities alike

JCUSER-IC8sJL1q

2025-05-09 12:40

What is Ethereum’s role in smart contracts?

What Is Ethereum’s Role in Smart Contracts?

Ethereum has become a cornerstone of blockchain technology, especially when it comes to enabling smart contracts. These self-executing agreements are transforming how transactions and digital interactions occur across various industries. Understanding Ethereum’s role in this ecosystem is essential for anyone interested in blockchain innovation, decentralized applications (dApps), or the future of digital finance.

How Ethereum Supports Smart Contracts

At its core, Ethereum provides a decentralized platform that allows developers to create and deploy smart contracts without relying on centralized authorities. Unlike traditional contracts that require intermediaries like lawyers or banks, smart contracts on Ethereum automatically execute predefined rules once certain conditions are met. This automation reduces costs, increases transparency, and minimizes the risk of manipulation.

Ethereum's blockchain acts as an immutable ledger where these contracts are stored and executed. Once deployed, they run exactly as programmed—no third-party intervention needed—ensuring trustless interactions between parties. This feature makes Ethereum particularly appealing for applications requiring high security and transparency.

Programming Languages Powering Smart Contracts

One of the key strengths of Ethereum is its support for specialized programming languages designed explicitly for writing smart contracts. Solidity is by far the most popular language used within the ecosystem; it resembles JavaScript in syntax but offers features tailored to blockchain development.

Developers can craft complex logic within their smart contracts using Solidity, enabling functionalities such as token creation (ERC-20 tokens), voting mechanisms, financial derivatives, or even gaming logic. The flexibility provided by these languages allows for innovative use cases across sectors like finance (DeFi), gaming (NFTs), supply chain management, and more.

Gas Fees: The Cost of Running Smart Contracts

Executing smart contracts on Ethereum isn’t free; it involves paying gas fees measured in Ether (ETH). Gas represents computational effort required to process transactions or contract executions on the network. When users initiate a transaction involving a smart contract—say transferring tokens or executing a DeFi trade—they must pay an amount proportional to the complexity involved.

This fee mechanism helps prevent spam attacks but also introduces considerations around cost efficiency during periods of high network congestion. Recent upgrades aim to optimize gas consumption while maintaining security standards—a critical factor influencing user adoption and developer activity.

Smart Contracts’ Role in Decentralized Applications

Smart contracts form the backbone of decentralized applications (dApps). These apps operate without central servers; instead, they rely entirely on code running securely on blockchains like Ethereum. From simple token swaps via platforms like Uniswap to complex lending protocols such as Aave or Compound—these dApps leverage smart contract logic extensively.

The ability to automate processes ensures that dApps can offer services with increased transparency and reduced reliance on intermediaries—a significant advantage over traditional centralized systems. As a result, industries ranging from finance to entertainment have embraced this technology for creating innovative solutions that prioritize user control over assets and data.

Security Challenges Associated With Smart Contracts

While offering numerous benefits—including automation and decentralization—smart contracts also pose security risks if not properly coded or audited. Bugs within contract code can lead to vulnerabilities exploitable by hackers; notable incidents include The DAO hack in 2016 which resulted in millions lost due to flawed code execution.

To mitigate these risks:

- Developers conduct thorough audits before deployment.

- Specialized firms provide security assessments.

- Formal verification methods are increasingly adopted.

Despite advancements in security practices, vulnerabilities remain possible due to human error or unforeseen edge cases within complex logic structures.

Scalability Issues And Upgrades Like Ethereum 2.0

As demand grows for dApps built atop Ethereum’s platform—including DeFi projects and NFTs—the network faces scalability challenges limiting transaction throughput and increasing fees during peak times. To address this:

- Ethereum 2.x aims at transitioning from proof-of-work (PoW) consensus mechanisms toward proof-of-stake (PoS).

- It introduces sharding techniques allowing parallel processing across multiple chains.

These upgrades promise faster transaction speeds with lower costs while enhancing overall network security—a crucial step toward mainstream adoption of blockchain-based solutions involving smart contracts.

Layer 2 Solutions Enhancing Performance

In addition to core upgrades:

- Layer 2 solutions such as Polygon (formerly Matic), Optimism, Arbitrum facilitate off-chain processing.

- They enable faster transactions at reduced costs by batching operations before settling them back onto mainnet.

These innovations help bridge current performance gaps until full-scale upgrades mature.

Regulatory Environment And Its Impact On Smart Contract Adoption

Legal frameworks surrounding blockchain technology continue evolving worldwide—and their influence directly affects how businesses develop with smart contracts on platforms like Ethereum:

- Governments seek clarity around issues such as securities classification for tokens created via smart contract protocols.

- Regulatory uncertainty may hinder innovation if overly restrictive policies emerge.

Conversely:

- Clear guidelines foster trust among users,

- Encourage institutional participation,

- Promote responsible development practices aligned with legal standards.

Importance Of Compliance And Auditing

Given potential legal implications:

- Regular audits ensure compliance with applicable regulations,

- Transparent documentation builds user confidence,3.. Collaboration between developers & regulators promotes sustainable growth.

Future Outlook: Risks And Opportunities

Despite impressive progress made through recent updates like ETH 2.x enhancements:

Risks remain, including:

- Security vulnerabilities leading potentially catastrophic losses,

- Regulatory uncertainties stalling broader adoption,

- Environmental concerns related mainly to energy-intensive proof-of-work models,

Opportunities abound through ongoing innovations:

1.. Continued scalability improvements will make dApps more accessible globally,2.. Growing sectors such as DeFi & NFTs expand use cases leveraging robust smart contract capabilities,3.. Increasing regulatory clarity could accelerate institutional involvement,

By balancing technological advancements with rigorous security measures—and aligning developments with evolving legal landscapes—Ethereum continues shaping its pivotal role at the heart of modern decentralized ecosystems.

Understanding how Ethereum supports intelligent automation through secure & scalable infrastructure reveals why it's considered foundational within blockchain technology today—and why ongoing developments will determine its future trajectory amidst emerging challenges & opportunities alike

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

Two leading Federal Reserve chair candidates are advocating aggressive rate cuts despite inflation concerns, potentially creating powerful tailwinds for cryptocurrency markets. With Trump considering 11 candidates to replace Jerome Powell in May 2026, dovish monetary policy could drive substantial crypto gains.

🏛️ Leading Dovish Candidates:

-

Marc Sumerlin: Former Bush admin economist advocating 50+ basis point cuts

David Zervos: Jefferies Chief Market Strategist supporting 200+ basis point total reduction

Key Position: Both believe current monetary policy is "offensively tight" despite PPI data

Trump Alignment: Both support lower borrowing costs and economic stimulus

📈 How Rate Cuts Boost Crypto:

-

Lower Opportunity Costs: Reduced bond/savings yields push investors toward crypto

Increased Liquidity: More money flowing into alternative investments

Dollar Weakness: Makes Bitcoin more attractive as store of value

Risk Appetite: Cheaper borrowing costs encourage higher-yield asset allocation

Historical Precedent: 2020-2021 crypto rally coincided with Fed accommodation

💎 Crypto Market Benefits:

-

Bitcoin: Enhanced digital store of value appeal during dollar weakness

Ethereum: Increased DeFi activity from improved liquidity conditions

Layer-1 Protocols: More developer activity and ecosystem growth

Infrastructure: Crypto companies access cheaper capital for expansion

Stablecoins: Expanded usage in lower-rate environments

🔍 Selection Process Impact:

-

11 Candidates: Diverse backgrounds from Fed officials to market strategists

Timeline: Prolonged uncertainty could create short-term volatility

Market Experience: Candidates like Zervos bring crypto-aware perspectives

Policy Clarity: Dovish positioning provides directional support regardless of final pick

📊 Historical Correlation:

-

2022 Struggle: Crypto fell as rates rose aggressively

2023-2024 Recovery: Crypto rallied as rate hikes peaked and cuts expected

Transmission Speed: Crypto markets react immediately to Fed policy changes

Sustained Impact: Rate cut campaigns provide ongoing support over months

⚠️ Key Considerations:

-

Regulatory uncertainty remains despite monetary tailwinds

Timing matters - gradual vs aggressive cuts create different market dynamics

Fed chair's approach to financial stability could impact crypto oversight

Monetary policy alone cannot drive sustained crypto adoption

🎯 Investment Implications: The combination of dovish Fed leadership and Trump's pro-crypto stance creates potentially explosive conditions for digital assets. Lower rates reduce competition from traditional investments while institutional appetite for alternatives increases dramatically.

Bottom Line: Fed chair candidates advocating aggressive rate cuts could unleash massive liquidity into crypto markets. Historical data shows strong correlations between accommodative monetary policy and crypto rallies. The May 2026 appointment could mark a pivotal moment for digital asset adoption.

Read the complete analysis on Fed chair candidates and crypto market implications: 👇 https://blog.jucoin.com/fed-chair-rate-cuts-crypto/?utm_source=blog

#FedChair #RateCuts #Crypto #Bitcoin #Ethereum

JU Blog

2025-08-16 08:50

💰 Fed Chair Rate Cuts Could Spark Massive Crypto Rally

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

📰 Điều gì đang thúc đẩy đà tăng của Ethereum — Và liệu nó có thể kéo dài? 🚀

Xem chia sẻ của Jucoin CEO Sammi Li về chủ đề này trên DecryptMedia 👇🏻

🔗 https://decrypt.co/335292/whats-driving-ethereums-surge-and-can-it-last

#JuCoin #JucoinVietnam #Ethereum #ETH #Blockchain

Lee | Ju.Com

2025-08-15 06:24

📰 Điều gì đang thúc đẩy đà tăng của Ethereum — Và liệu nó có thể kéo dài? 🚀

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

📰 Tom Lee đặt mục tiêu #Ethereum đạt 15,000 USD vào năm 2025, nhờ vào kho $ETH kỷ lục 5 tỷ USD của #BitMine. Chiến lược này tận dụng tăng trưởng #Stablecoin từ 250 tỷ USD lên 2 nghìn tỷ USD và 60% thị phần của #Ethereum trong mảng token hóa tài sản thực.

🔎 Đọc thêm: https://blog.jucoin.com/tom-lee-ethereum-prediction/

#JuCoin #JucoinVietnam #JucoinInsight #Ethereum #ETH #Crypto #Blockchain #CryptoNews #PricePrediction #Tokenization #Stablecoin

Lee | Ju.Com

2025-08-15 06:25

🌟Jucoin Insight | Dự đoán giá #Ethereum của Tom Lee: Mục tiêu 15,000 USD vào 2025! 🚀

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

The crypto market experienced significant losses in August 2025, with most major tokens posting notable declines. Here's what's driving the downturn and what investors need to know:

💰 Major Losses Overview:

-

Bitcoin (BTC): -8% to $113,562

Ethereum (ETH): -5.2% to $4,166

Cardano (ADA): -6.3% to $0.8526

XRP: -3.77% to $2.89

Dogecoin (DOGE): -2.21% to $0.2127

🎯 Key Market Drivers:

1️⃣ Jackson Hole Uncertainty: Fed rate cut expectations dropped from 98% to 15%, dampening institutional risk appetite

2️⃣ ETF Volatility: Ethereum ETFs saw $196.6 million outflows after a record $2.8 billion inflow the previous week

3️⃣ Regulatory Delays: Stalled altcoin ETF approvals and unclear stablecoin legislation adding market anxiety

4️⃣ Technical Liquidations: Over $1.2 billion in long positions liquidated as Bitcoin hit resistance at $124,000

🚨 Security Concerns:

-

AI-powered wallet drainers targeting developers

$2.17 billion in crypto hacks recorded in 2025

GreedyBear exploit affecting 150+ fake browser extensions

🏆 Biggest Altcoin Losers (24h):

-

Gari Network (GARI): -23.15%

Useless Coin (USELESS): -17.98%

League of Kingdoms Arena (LOKA): -10.03%

Livepeer (LPT): -9.90%

💡 What's Next:

-

All eyes on Powell's Jackson Hole speech for Fed policy signals

ETF flows remain key indicator for short-term price action

Most analysts view this as temporary correction, not trend reversal

Long-term fundamentals remain intact despite current volatility

The market correction appears driven by macro uncertainty rather than fundamental crypto weaknesses. Investors are consolidating positions ahead of key policy announcements.

Read the complete market analysis with detailed charts and expert insights: 👇 https://blog.jucoin.com/crypto-losses-recent-key-market-declines-explained/

#CryptoLosses #Bitcoin #Ethereum

JU Blog

2025-08-20 10:37

📉 Crypto Market Takes Sharp Hit: Major Tokens Down 3-8% This Week

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

n a landmark Bankless interview marking Ethereum's 10th anniversary, co-founder Vitalik Buterin unveiled his comprehensive roadmap transforming Ethereum from "world computer" to "world ledger" - the platform that stores civilization's assets and records.

💰 Key Vision Highlights:

-

Identity Evolution: Clear pivot to "world ledger" positioning for institutional adoption

Privacy Revolution: ZK-powered privacy becomes DEFAULT, not optional

Massive Scaling: 10,000 TPS on Layer 1 through ZK-proof verification

Treasury Strategy: Cautious support for ETH treasury companies worth $12B

🎯 Technical Roadmap:

1️⃣ ZK-EVM Integration: Complete within one year for simplified verification 2️⃣ Privacy-by-Default: Direct wallet integration eliminating specialized privacy apps 3️⃣ Protocol Simplification: Reduced complexity while preserving programmability 4️⃣ Gas Limit Scaling: Progressive increases toward 10,000 TPS capacity

🏆 Revolutionary Features Coming:

-

Privacy Wallets: Seamless public/private balance management in MetaMask

Scalable Privacy Pools: Exclude bad actors while protecting legitimate users

Cross-L2 Interoperability: Minutes instead of hours for withdrawals

Hardware Accessibility: Even "$7 Raspberry Pi" can validate ZK-proofs

💡 Strategic Insights:

-

Barbell Strategy: L1 optimized for security, L2 for performance and UX

Quantum Resistance: Post-quantum cryptography implementation planned

Cypherpunk Renaissance: Return to original privacy-focused values

Conservative Leverage: Warning against overleveraged ETH treasury risks

🔥 Market Implications:

With BlackRock endorsing Ethereum as the "master ledger for the world" and 3.04 million ETH ($12B) held by treasury companies, Buterin's vision positions Ethereum as foundational global infrastructure while maintaining decentralized ethos.

The transition from experimental platform to civilization-scale registry represents the next phase of blockchain adoption - moving beyond speculation toward real economic utility.

Read the complete technical analysis and implementation timeline: 👇 https://blog.jucoin.com/vitalik-buterin-ethereum-world-ledger-vision/

#Ethereum #VitalikButerin #ETH

JU Blog

2025-08-13 07:46

🚀 Vitalik Buterin Reveals Ethereum's "World Ledger" Vision for the Next Decade!

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

What is Account Abstraction (EIP-4337)?

Understanding Ethereum Accounts and Their Limitations

Ethereum, the leading blockchain platform for decentralized applications, has traditionally relied on two main types of accounts: externally owned accounts (EOAs) and contract accounts. EOAs are controlled by private keys and are used by users to send transactions, while contract accounts are governed by smart contracts that execute code autonomously. However, this binary structure presents certain limitations in terms of flexibility, security, and user experience.

For example, EOAs require users to manage private keys securely—an often complex task that can lead to loss of funds if mishandled. Contract accounts lack the ability to perform certain operations without external triggers or specific transaction structures. As Ethereum's ecosystem expands into areas like DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and enterprise solutions, these constraints hinder seamless user interactions and advanced functionalities.

This context has driven the development of Account Abstraction, a concept aimed at redefining how Ethereum accounts function—making them more versatile and adaptable to modern needs.

What Is Account Abstraction?

Account abstraction refers to a paradigm shift in Ethereum's account model that allows for more flexible account behaviors beyond simple storage of Ether or tokens. Instead of being limited to basic transaction validation via private keys, abstracted accounts can incorporate custom logic for authorization, multi-signature schemes, social recovery mechanisms, or even biometric authentication.

Specifically related to EIP-4337—a prominent proposal within this space—it introduces a new layer where user operations are processed differently from traditional transactions. This enables users to execute complex actions without relying solely on externally owned wallets or traditional smart contracts as intermediaries.

In essence, account abstraction aims to make blockchain interactions more intuitive while enhancing security features such as multi-factor authentication or time-locks directly integrated into account logic.

The Context Behind EIP-4337 Development

The push towards account abstraction stems from several challenges faced by the Ethereum community:

User Experience: Managing private keys is cumbersome for many users; losing access means losing funds.

Security Risks: Private key management exposes vulnerabilities; compromised keys lead directly to asset theft.

Smart Contract Limitations: Existing models do not support advanced features like social recovery or flexible authorization schemes natively.

Scalability & Usability Needs: As DeFi grows exponentially with millions engaging in financial activities on-chain — there’s a pressing need for smarter account management systems that can handle complex workflows efficiently.

In response these issues have prompted proposals like EIP-4337 which aim at creating an improved framework where user operations can be processed more flexibly while maintaining compatibility with existing infrastructure.

Key Features of EIP-4337

Introduced in 2021 by members of the Ethereum community through extensive discussions and development efforts, EIP-4337 proposes several core innovations:

Abstract Accounts & Signers

The proposal introduces two primary components:

- Abstract Accounts: These are enhanced wallet-like entities capable of executing arbitrary transactions based on custom logic embedded within them.

- Abstract Signers: They facilitate signing transactions without exposing sensitive details—enabling features like multi-signature requirements seamlessly integrated into the account itself rather than relying solely on external wallets.

Improved Security Mechanisms

EIP-4337 emphasizes security enhancements such as:

- Multi-signature requirements ensuring multiple approvals before executing critical actions.

- Time-locks preventing immediate transfers—adding layers against unauthorized access.

- Social recovery options allowing trusted contacts or mechanisms restoring access if private keys are lost.

Compatibility & Transition

A significant aspect is backward compatibility with existing Ethereum infrastructure—meaning developers can adopt new features gradually without disrupting current applications or wallets during transition phases.

Recent Progress and Community Engagement

Since its proposal in 2021:

- The idea has gained substantial support among developers aiming at making blockchain interactions safer and easier.

- Multiple projects have begun testing implementations within testnets; some wallets now experiment with integrating abstracted account capabilities.

- Discussions continue around scalability concerns; critics worry about increased complexity potentially impacting network performance if not carefully managed.

Despite ongoing debates about potential scalability bottlenecks—which could arise from added computational overhead—the consensus remains optimistic about its long-term benefits when properly implemented.

Challenges Facing Implementation

While promising, adopting EIP-4337 involves navigating several hurdles:

Scalability Concerns

Adding sophisticated logic directly into accounts might increase transaction processing times or block sizes unless optimized effectively—a crucial consideration given Ethereum’s current throughput limits.

Regulatory Implications

Enhanced security features such as social recovery could raise questions around compliance with legal standards related to identity verification and anti-money laundering regulations across jurisdictions worldwide.

Adoption Timeline

Although initial testing phases began around 2022–2023—with some projects already integrating elements—the full rollout depends heavily on network upgrades (like Shanghai/Capella upgrades) scheduled over upcoming ETH network hard forks.

How Account Abstraction Shapes Future Blockchain Use Cases

If successfully implemented at scale:

- Users will enjoy simplified onboarding processes—no longer needing complex seed phrases managed manually.

- Developers will gain tools for building smarter dApps capable of handling multi-layered permissions natively within user accounts themselves.

- Security protocols will become more robust through customizable safeguards embedded directly into wallet logic rather than relying solely on external hardware solutions.

This evolution aligns well with broader trends toward decentralization combined with enhanced usability—a key factor driving mainstream adoption beyond crypto enthusiasts toward everyday consumers.

By reimagining how identities interact within blockchain ecosystems through proposals like EIP-4337—and addressing longstanding usability issues—it paves the way toward a future where decentralized finance becomes accessible yet secure enough for mass adoption. As ongoing developments unfold over 2024+, observing how communities adapt these innovations will be crucial in understanding their impact across various sectors—from finance institutions adopting blockchain-based identity solutions to individual users seeking safer ways to manage digital assets efficiently.

JCUSER-WVMdslBw

2025-05-14 12:53

What is account abstraction (EIP-4337)?

What is Account Abstraction (EIP-4337)?

Understanding Ethereum Accounts and Their Limitations

Ethereum, the leading blockchain platform for decentralized applications, has traditionally relied on two main types of accounts: externally owned accounts (EOAs) and contract accounts. EOAs are controlled by private keys and are used by users to send transactions, while contract accounts are governed by smart contracts that execute code autonomously. However, this binary structure presents certain limitations in terms of flexibility, security, and user experience.

For example, EOAs require users to manage private keys securely—an often complex task that can lead to loss of funds if mishandled. Contract accounts lack the ability to perform certain operations without external triggers or specific transaction structures. As Ethereum's ecosystem expands into areas like DeFi (Decentralized Finance), NFTs (Non-Fungible Tokens), and enterprise solutions, these constraints hinder seamless user interactions and advanced functionalities.

This context has driven the development of Account Abstraction, a concept aimed at redefining how Ethereum accounts function—making them more versatile and adaptable to modern needs.

What Is Account Abstraction?

Account abstraction refers to a paradigm shift in Ethereum's account model that allows for more flexible account behaviors beyond simple storage of Ether or tokens. Instead of being limited to basic transaction validation via private keys, abstracted accounts can incorporate custom logic for authorization, multi-signature schemes, social recovery mechanisms, or even biometric authentication.

Specifically related to EIP-4337—a prominent proposal within this space—it introduces a new layer where user operations are processed differently from traditional transactions. This enables users to execute complex actions without relying solely on externally owned wallets or traditional smart contracts as intermediaries.

In essence, account abstraction aims to make blockchain interactions more intuitive while enhancing security features such as multi-factor authentication or time-locks directly integrated into account logic.

The Context Behind EIP-4337 Development

The push towards account abstraction stems from several challenges faced by the Ethereum community:

User Experience: Managing private keys is cumbersome for many users; losing access means losing funds.

Security Risks: Private key management exposes vulnerabilities; compromised keys lead directly to asset theft.

Smart Contract Limitations: Existing models do not support advanced features like social recovery or flexible authorization schemes natively.

Scalability & Usability Needs: As DeFi grows exponentially with millions engaging in financial activities on-chain — there’s a pressing need for smarter account management systems that can handle complex workflows efficiently.

In response these issues have prompted proposals like EIP-4337 which aim at creating an improved framework where user operations can be processed more flexibly while maintaining compatibility with existing infrastructure.

Key Features of EIP-4337

Introduced in 2021 by members of the Ethereum community through extensive discussions and development efforts, EIP-4337 proposes several core innovations:

Abstract Accounts & Signers

The proposal introduces two primary components:

- Abstract Accounts: These are enhanced wallet-like entities capable of executing arbitrary transactions based on custom logic embedded within them.

- Abstract Signers: They facilitate signing transactions without exposing sensitive details—enabling features like multi-signature requirements seamlessly integrated into the account itself rather than relying solely on external wallets.

Improved Security Mechanisms

EIP-4337 emphasizes security enhancements such as:

- Multi-signature requirements ensuring multiple approvals before executing critical actions.

- Time-locks preventing immediate transfers—adding layers against unauthorized access.

- Social recovery options allowing trusted contacts or mechanisms restoring access if private keys are lost.

Compatibility & Transition

A significant aspect is backward compatibility with existing Ethereum infrastructure—meaning developers can adopt new features gradually without disrupting current applications or wallets during transition phases.

Recent Progress and Community Engagement

Since its proposal in 2021:

- The idea has gained substantial support among developers aiming at making blockchain interactions safer and easier.

- Multiple projects have begun testing implementations within testnets; some wallets now experiment with integrating abstracted account capabilities.

- Discussions continue around scalability concerns; critics worry about increased complexity potentially impacting network performance if not carefully managed.

Despite ongoing debates about potential scalability bottlenecks—which could arise from added computational overhead—the consensus remains optimistic about its long-term benefits when properly implemented.

Challenges Facing Implementation

While promising, adopting EIP-4337 involves navigating several hurdles:

Scalability Concerns

Adding sophisticated logic directly into accounts might increase transaction processing times or block sizes unless optimized effectively—a crucial consideration given Ethereum’s current throughput limits.

Regulatory Implications

Enhanced security features such as social recovery could raise questions around compliance with legal standards related to identity verification and anti-money laundering regulations across jurisdictions worldwide.

Adoption Timeline

Although initial testing phases began around 2022–2023—with some projects already integrating elements—the full rollout depends heavily on network upgrades (like Shanghai/Capella upgrades) scheduled over upcoming ETH network hard forks.

How Account Abstraction Shapes Future Blockchain Use Cases

If successfully implemented at scale:

- Users will enjoy simplified onboarding processes—no longer needing complex seed phrases managed manually.

- Developers will gain tools for building smarter dApps capable of handling multi-layered permissions natively within user accounts themselves.

- Security protocols will become more robust through customizable safeguards embedded directly into wallet logic rather than relying solely on external hardware solutions.

This evolution aligns well with broader trends toward decentralization combined with enhanced usability—a key factor driving mainstream adoption beyond crypto enthusiasts toward everyday consumers.

By reimagining how identities interact within blockchain ecosystems through proposals like EIP-4337—and addressing longstanding usability issues—it paves the way toward a future where decentralized finance becomes accessible yet secure enough for mass adoption. As ongoing developments unfold over 2024+, observing how communities adapt these innovations will be crucial in understanding their impact across various sectors—from finance institutions adopting blockchain-based identity solutions to individual users seeking safer ways to manage digital assets efficiently.

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

Fundstrat's Tom Lee, the strategist who correctly called Bitcoin's 2017 surge, has made his boldest prediction yet: Ethereum could hit $15,000 by year-end 2025. His conviction is backed by BitMine Immersion Technologies' record-breaking $5 billion ETH treasury accumulation.

💰 The Bold Investment Thesis:

-

Price Target: $4K by July, $10K-$15K by year-end 2025 (400% upside potential)

Corporate Treasury: 1.15 million ETH ($5B) - world's largest corporate Ethereum position

Growth Strategy: Targeting 5% of total ETH supply (~6 million tokens worth $25B+)

Market Driver: Stablecoin explosion from $250B to $2T market cap

🎯 Key Catalysts Driving the Prediction:

1️⃣ Stablecoin Dominance: Ethereum powers 60%+ of all stablecoin transactions - the "ChatGPT moment" for crypto adoption 2️⃣ Wall Street's Choice: Institutions prefer Ethereum for regulatory compliance and established infrastructure 3️⃣ Real-World Assets: 60% market share in asset tokenization as traditional finance goes digital 4️⃣ Treasury Strategy: BitMine accumulating ETH 12x faster than MicroStrategy's Bitcoin pace

🏆 BitMine's Aggressive Accumulation:

-

Holdings: 1.15M ETH worth ~$5B (targeting 5% of total supply)

Stock Performance: BMNR up 634% year-to-date

Trading Volume: $1.6B daily, rivaling major corporations

Expansion: $24.5B equity offering for additional acquisitions

Staking Rewards: Earning ~3% annual yields on ETH holdings

💡 The "Digital Infrastructure" Thesis:

Why ETH > BTC for Institutions:

-

Bitcoin = Digital Gold (store of value)

Ethereum = Financial Infrastructure (powers the digital economy)

Stablecoins creating viral adoption among banks, merchants, consumers

JPMorgan, Visa, Robinhood building on Ethereum infrastructure

🔥 Technical Analysis & Targets:

-

Immediate: $4,000 breakout level (July 2025)

Historical Ratio: ETH/BTC returning to 2017 peak suggests $16,000 potential

Fundamental Value: Circle's 100x EBITDA multiple applied to Ethereum = $10K+ fair value

Network Effects: 10-year operational history without downtime = institutional confidence

📊 Market Transformation Indicators:

-

Stablecoin Growth: 8x expansion potential ($250B → $2T)

Fee Revenue: 10x network fee growth from increased usage

Regulatory Support: GENIUS Act providing legal framework

Corporate Adoption: Treasury strategies becoming mainstream

⚠️ Investment Considerations:

Opportunities:

-

Leveraged exposure through BitMine stock (BMNR)

Direct ETH investment at potentially attractive entry points

1-2% portfolio allocation recommended for conservative investors

Risks:

-

Blockchain competition (Solana, others offering faster/cheaper alternatives)

Regulatory uncertainties around stablecoins

Market volatility (30-50% drawdowns possible)

Layer 2 scaling potentially reducing Layer 1 value capture

💎 Bottom Line:

Tom Lee's $15K Ethereum prediction isn't just price speculation—it's a thesis about Ethereum becoming the backbone of digitized traditional finance. With BitMine's $5B bet and stablecoin adoption accelerating, Ethereum could experience its "Bitcoin 2017 moment" driven by institutional adoption rather than retail speculation.

The strategy mirrors MicroStrategy's Bitcoin approach but focuses on Ethereum's unique utility in powering the next generation of financial infrastructure. Success depends on continued stablecoin growth and real-world asset tokenization dominance.

Read the complete analysis and investment strategy breakdown: 👇 https://blog.jucoin.com/tom-lee-ethereum-prediction/

#Ethereum #TomLee #BitMine

JU Blog

2025-08-13 07:50

🚀 Wall Street Legend Tom Lee Predicts Ethereum $15K by 2025 with $5B Corporate Bet!

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

What Is Proof-of-Stake (PoS)?

Proof-of-Stake (PoS) is a consensus mechanism used in blockchain technology to validate transactions and secure the network. Unlike the traditional Proof-of-Work (PoW), which relies on miners solving complex mathematical puzzles through energy-intensive computations, PoS selects validators based on the amount of cryptocurrency they "stake" or lock up as collateral. This approach aims to create a more efficient, scalable, and environmentally friendly way of maintaining blockchain integrity.

How Does Proof-of-Stake Work?

In a PoS system, participants known as validators are chosen to create new blocks based on their stake in the network. The more coins a validator commits, the higher their chances of being selected to validate transactions and add new blocks to the chain. This process involves several key steps:

- Staking: Validators lock up a specific amount of cryptocurrency as collateral.

- Validator Selection: The network randomly or deterministically selects validators based on factors like stake size and sometimes other criteria such as coin age.

- Validation: Selected validators verify transactions within proposed blocks.

- Reward & Penalties: Successful validation earns rewards; misbehavior results in penalties like slashing—where part or all of their staked coins are forfeited.

This method ensures that those with more at stake have greater incentive to act honestly since malicious activity can lead to significant financial loss.

Advantages of Proof-of-Stake

Proof-of-Stake offers several benefits over traditional PoW systems:

Energy Efficiency

One of PoS's most significant advantages is its lower energy consumption. Since it eliminates the need for computationally intensive mining operations, it reduces electricity usage drastically—making blockchain networks more sustainable and environmentally friendly.

Scalability

PoS allows for faster transaction processing times and higher throughput compared to PoW networks. This scalability makes it suitable for applications requiring high-speed data validation without compromising security.

Security Features

While no system is entirely immune from attacks, well-designed PoS protocols incorporate mechanisms like slashing penalties that discourage malicious behavior. Additionally, because validators risk losing their staked assets if they act dishonestly, this creates economic incentives aligned with honest participation.

Challenges & Risks Associated With Proof-of-Stake

Despite its advantages, PoS faces certain challenges that developers and stakeholders must address:

Nothing-at-Stake Problem

In some early implementations of PoS, validators could vote for multiple conflicting chains without penalty—a situation called "nothing-at-stake." To mitigate this risk, modern protocols implement slashing conditions where misbehavior leads to penalties severe enough to deter such actions.

Centralization Concerns

Since larger stakeholders have increased influence over block creation probabilities, there's potential for wealth concentration leading to centralization risks—where power becomes concentrated among few large holders rather than distributed evenly across participants.

Security Considerations

Although generally considered secure when properly implemented, emerging attack vectors specific to staking systems require ongoing research and protocol improvements. Continuous updates help maintain resilience against threats like long-range attacks or validator collusion.

Ethereum’s Transition From Proof-of-Work To Proof-of-Stake

Ethereum’s move from proof-of-work (PoW) toward proof-of-stake (PoS) represents one of the most prominent real-world applications demonstrating this consensus mechanism's potential. Launched initially in December 2020 via its Beacon Chain upgrade—the first phase towards Ethereum 2.0—the transition aimed at addressing scalability issues while significantly reducing energy consumption associated with mining activities.

The milestone event called "The Merge," completed in 2023 after years of development effort by Ethereum developers worldwide—including extensive testing—marked Ethereum’s full switch from energy-intensive mining toward an eco-friendly staking model. This shift not only enhances sustainability but also paves the way for future upgrades focused on increasing transaction throughput through sharding techniques integrated into Eth2 architecture.

Future Outlook & Adoption Trends

As major cryptocurrencies adopt proof-of-stake mechanisms—including Cardano (ADA), Solana (SOL), Polkadot (DOT), among others—the landscape is witnessing rapid growth driven by both technological advancements and environmental considerations. Stakeholder interest continues rising due primarily to benefits like reduced operational costs and improved scalability prospects which appeal both investors seeking returns via staking rewards—and developers aiming for robust decentralized applications capable of handling mass adoption scenarios efficiently.

However, widespread adoption also brings regulatory scrutiny; authorities worldwide are beginning scrutinizing staking practices concerning investor protections and compliance frameworks—a factor that could influence future development directions within this space significantly.

Key Takeaways About Proof-of-Stake

To summarize what makes proof-of-stake distinct:

- Validators participate by locking up tokens instead of performing resource-heavy computations.

- It offers superior energy efficiency compared with proof-of-work.

- Security relies heavily on economic incentives; misbehavior results in financial penalties.

- Major networks like Ethereum have successfully transitioned or plan transitions towards PoS models.

Understanding these core aspects helps users evaluate whether adopting or supporting proof-based blockchain projects aligns with their goals—whether it's investing safely or developing scalable decentralized solutions.

Addressing User Concerns & Trustworthiness

For users considering involvement in staking activities—or simply wanting clarity about how these systems operate—it’s crucial first understanding security measures involved such as slashing conditions designed specifically against malicious actions—and how decentralization efforts aim at preventing undue influence by large stakeholders alone.

Furthermore,

- Look into reputable platforms offering staking services,

- Review governance structures ensuring transparency,

- Stay updated about ongoing protocol improvements addressing vulnerabilities,

are essential steps toward engaging confidently within evolving proof-based ecosystems.

Final Thoughts

Proof-of-stake has emerged as an innovative alternative that addresses many limitations inherent in traditional blockchain consensus mechanisms while promoting sustainability through reduced energy use—and fostering scalability necessary for mainstream adoption today’s digital economy demands increasingly efficient infrastructure solutions rooted firmly in trustworthiness backed by transparent governance models.

JCUSER-WVMdslBw

2025-05-11 10:39

What is proof-of-stake?

What Is Proof-of-Stake (PoS)?

Proof-of-Stake (PoS) is a consensus mechanism used in blockchain technology to validate transactions and secure the network. Unlike the traditional Proof-of-Work (PoW), which relies on miners solving complex mathematical puzzles through energy-intensive computations, PoS selects validators based on the amount of cryptocurrency they "stake" or lock up as collateral. This approach aims to create a more efficient, scalable, and environmentally friendly way of maintaining blockchain integrity.

How Does Proof-of-Stake Work?

In a PoS system, participants known as validators are chosen to create new blocks based on their stake in the network. The more coins a validator commits, the higher their chances of being selected to validate transactions and add new blocks to the chain. This process involves several key steps:

- Staking: Validators lock up a specific amount of cryptocurrency as collateral.

- Validator Selection: The network randomly or deterministically selects validators based on factors like stake size and sometimes other criteria such as coin age.

- Validation: Selected validators verify transactions within proposed blocks.

- Reward & Penalties: Successful validation earns rewards; misbehavior results in penalties like slashing—where part or all of their staked coins are forfeited.

This method ensures that those with more at stake have greater incentive to act honestly since malicious activity can lead to significant financial loss.

Advantages of Proof-of-Stake

Proof-of-Stake offers several benefits over traditional PoW systems:

Energy Efficiency

One of PoS's most significant advantages is its lower energy consumption. Since it eliminates the need for computationally intensive mining operations, it reduces electricity usage drastically—making blockchain networks more sustainable and environmentally friendly.

Scalability

PoS allows for faster transaction processing times and higher throughput compared to PoW networks. This scalability makes it suitable for applications requiring high-speed data validation without compromising security.

Security Features

While no system is entirely immune from attacks, well-designed PoS protocols incorporate mechanisms like slashing penalties that discourage malicious behavior. Additionally, because validators risk losing their staked assets if they act dishonestly, this creates economic incentives aligned with honest participation.

Challenges & Risks Associated With Proof-of-Stake

Despite its advantages, PoS faces certain challenges that developers and stakeholders must address:

Nothing-at-Stake Problem

In some early implementations of PoS, validators could vote for multiple conflicting chains without penalty—a situation called "nothing-at-stake." To mitigate this risk, modern protocols implement slashing conditions where misbehavior leads to penalties severe enough to deter such actions.

Centralization Concerns

Since larger stakeholders have increased influence over block creation probabilities, there's potential for wealth concentration leading to centralization risks—where power becomes concentrated among few large holders rather than distributed evenly across participants.

Security Considerations

Although generally considered secure when properly implemented, emerging attack vectors specific to staking systems require ongoing research and protocol improvements. Continuous updates help maintain resilience against threats like long-range attacks or validator collusion.

Ethereum’s Transition From Proof-of-Work To Proof-of-Stake

Ethereum’s move from proof-of-work (PoW) toward proof-of-stake (PoS) represents one of the most prominent real-world applications demonstrating this consensus mechanism's potential. Launched initially in December 2020 via its Beacon Chain upgrade—the first phase towards Ethereum 2.0—the transition aimed at addressing scalability issues while significantly reducing energy consumption associated with mining activities.

The milestone event called "The Merge," completed in 2023 after years of development effort by Ethereum developers worldwide—including extensive testing—marked Ethereum’s full switch from energy-intensive mining toward an eco-friendly staking model. This shift not only enhances sustainability but also paves the way for future upgrades focused on increasing transaction throughput through sharding techniques integrated into Eth2 architecture.

Future Outlook & Adoption Trends

As major cryptocurrencies adopt proof-of-stake mechanisms—including Cardano (ADA), Solana (SOL), Polkadot (DOT), among others—the landscape is witnessing rapid growth driven by both technological advancements and environmental considerations. Stakeholder interest continues rising due primarily to benefits like reduced operational costs and improved scalability prospects which appeal both investors seeking returns via staking rewards—and developers aiming for robust decentralized applications capable of handling mass adoption scenarios efficiently.

However, widespread adoption also brings regulatory scrutiny; authorities worldwide are beginning scrutinizing staking practices concerning investor protections and compliance frameworks—a factor that could influence future development directions within this space significantly.

Key Takeaways About Proof-of-Stake

To summarize what makes proof-of-stake distinct:

- Validators participate by locking up tokens instead of performing resource-heavy computations.

- It offers superior energy efficiency compared with proof-of-work.

- Security relies heavily on economic incentives; misbehavior results in financial penalties.

- Major networks like Ethereum have successfully transitioned or plan transitions towards PoS models.

Understanding these core aspects helps users evaluate whether adopting or supporting proof-based blockchain projects aligns with their goals—whether it's investing safely or developing scalable decentralized solutions.

Addressing User Concerns & Trustworthiness

For users considering involvement in staking activities—or simply wanting clarity about how these systems operate—it’s crucial first understanding security measures involved such as slashing conditions designed specifically against malicious actions—and how decentralization efforts aim at preventing undue influence by large stakeholders alone.

Furthermore,

- Look into reputable platforms offering staking services,

- Review governance structures ensuring transparency,

- Stay updated about ongoing protocol improvements addressing vulnerabilities,

are essential steps toward engaging confidently within evolving proof-based ecosystems.

Final Thoughts

Proof-of-stake has emerged as an innovative alternative that addresses many limitations inherent in traditional blockchain consensus mechanisms while promoting sustainability through reduced energy use—and fostering scalability necessary for mainstream adoption today’s digital economy demands increasingly efficient infrastructure solutions rooted firmly in trustworthiness backed by transparent governance models.

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

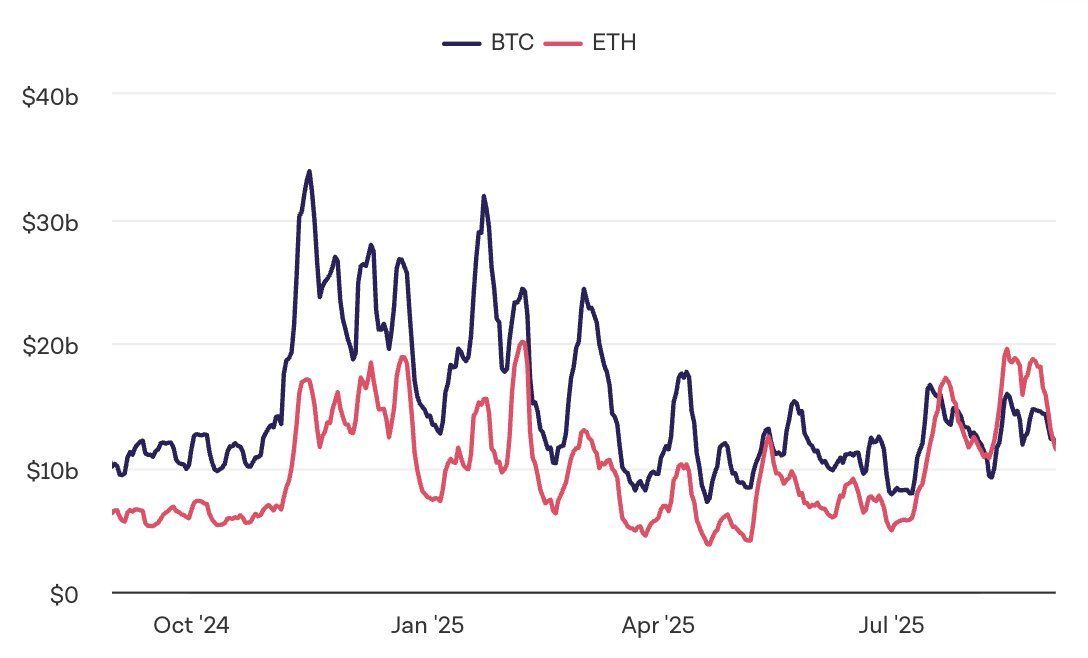

For the first time in 7 years, $ETH > $BTC in 7-day spot volume, per The Block. 🔁 👉 Bitcoin whales are rotating heavily into Ethereum.

With capital reallocating + rate cut anticipation, analysts now eye fresh ATHs in Q4 for majors.

#Ethereum #Bitcoin #cryptocurrency #blockchain

Carmelita

2025-09-04 16:37

🚨 Historic Shift on CEXs

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

Début de mois = possible dip 📉 2ᵉ moitié = éventuelle étincelle si la Fed coupe les taux 🔥

👉 Septembre pourrait être le mois pour se positionner avant le prochain leg haussier. 🚀

#Ethereum #crypto

Carmelita

2025-08-30 23:40

$ETH – Septembre en ligne de mire

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

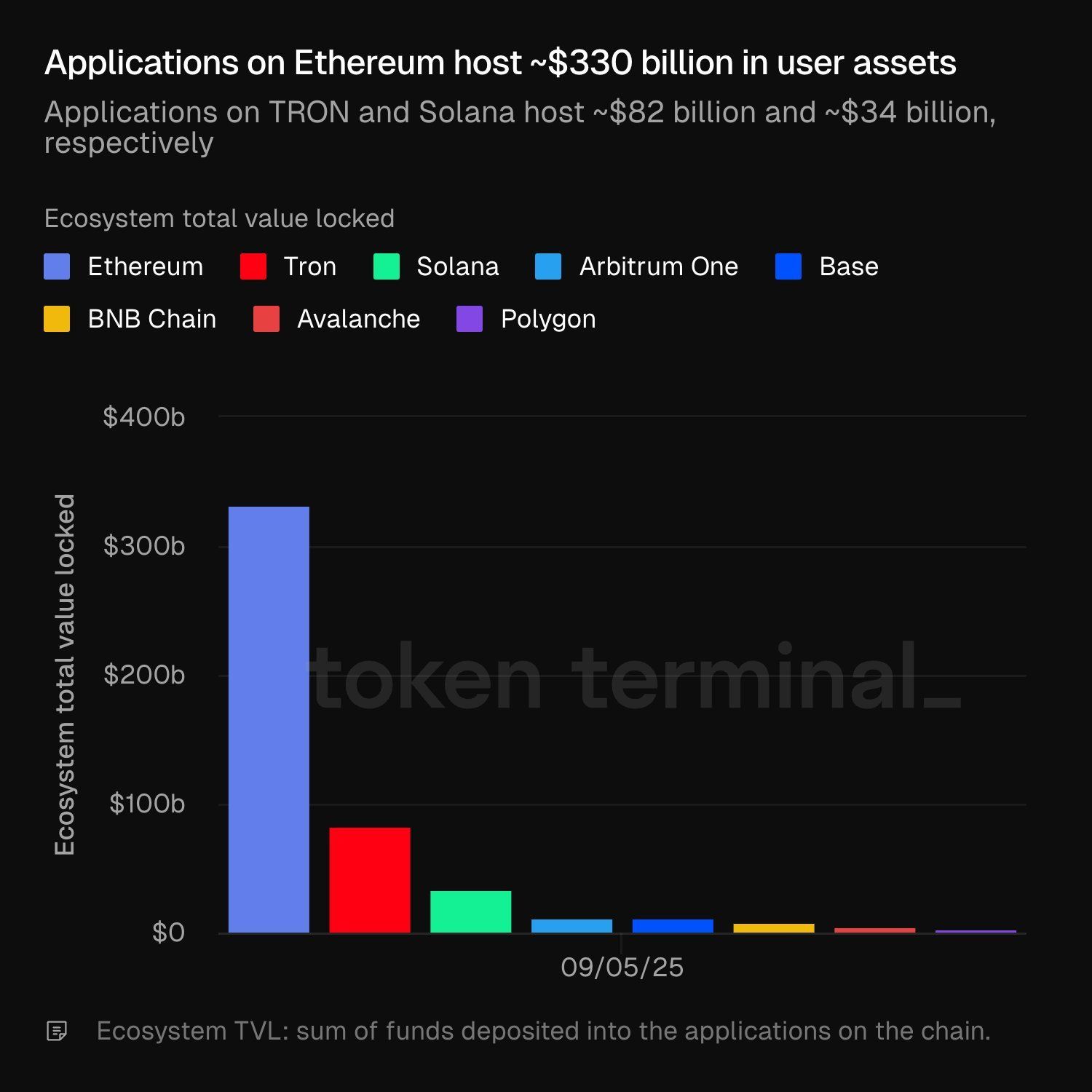

$TRX/USDT : ~$82B |$SOL/USDT : ~$34B

Le TVL des écosystèmes révèle où le vrai capital circule. Suivez les flux et soyez prêts pour la prochaine opportunité. 👀

#Ethereum #CryptoInsights #cryptocurrency #blockchain

Carmelita

2025-09-06 16:53

🔥 Ethereum domine le game !

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

➡️ Achat de 2,588 $BTC/USDT pour 258,8 M$ 🟢 ➡️ Vente de 35,009 $ETH/USDT pour 152,7 M$ 🔴

Un rééquilibrage massif qui en dit long sur leur vision court-terme du marché. 👀

#Bitcoin #Ethereum #cryptocurrency #blockchain

Carmelita

2025-09-04 13:11

🔥 Mouvement stratégique de BlackRock aujourd’hui

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

How Has the Net Staking Participation Rate Evolved on Ethereum Since the Merge?

Understanding Ethereum’s Transition to Proof of Stake

Ethereum's transition from proof-of-work (PoW) to proof-of-stake (PoS), known as "The Merge," took place on September 15, 2022. This significant upgrade aimed to enhance the network’s scalability, security, and energy efficiency. Unlike PoW, which relies on miners solving complex puzzles to validate transactions, PoS depends on validators who stake their ETH tokens to participate in consensus. This shift was driven by a desire to reduce energy consumption and improve network sustainability while maintaining decentralization.

Initial Impact of The Merge on Validator Participation

Immediately following The Merge, there was a notable surge in validator activity. Many users and institutions saw staking as an attractive opportunity due to the potential for earning rewards through newly minted ETH. This initial enthusiasm led to a rapid increase in active validators—participants actively involved in validating transactions and securing the network.

This spike reflected both market optimism and confidence in Ethereum’s new consensus mechanism. Validators were incentivized not only by staking rewards but also by supporting a more sustainable blockchain infrastructure. During this period, participation rates reached high levels compared with pre-Merge figures.

Trends in Validator Growth Post-Merge

Since that initial surge, data indicates that while validator participation has stabilized somewhat, there has been consistent growth in total validator numbers over time. The number of active validators tends to fluctuate based on market conditions but generally shows an upward trend.

This steady increase suggests ongoing interest from individual investors and institutional players alike who recognize staking as a long-term opportunity within Ethereum's ecosystem. As more ETH is staked—either directly or via third-party services—the overall security of the network continues improving due to increased decentralization efforts.

Factors Influencing Staking Participation Rates

Several key factors influence how many validators participate actively:

Market Volatility: Cryptocurrency markets are inherently volatile; during downturns or periods of high fluctuation, some validators may choose temporarily or permanently exit their positions either for risk mitigation or profit-taking.

Staking Rewards: The attractiveness of staking rewards plays a crucial role; higher yields tend to encourage more participation while reductions can lead some participants to withdraw.

Regulatory Environment: Legal clarity around crypto assets impacts validator engagement significantly. Favorable regulations can boost confidence among participants; uncertainty may cause hesitation or withdrawal.

Network Security Measures: Protocol upgrades like Casper FFG aim at preventing centralization risks by incentivizing diverse validator participation across different entities.

Challenges: Centralization Risks & Economic Incentives

While increased validator numbers are positive for decentralization and security, there's always concern about centralization—where control over large portions of staked ETH could threaten network integrity. If too few entities hold significant stakes (a phenomenon called "rich-get-richer"), it could undermine Ethereum's decentralized ethos despite technical safeguards like Casper FFG designed for fairness.

Economic incentives remain vital: if staking rewards diminish due to protocol changes or market conditions such as declining ETH prices relative to fiat currencies, fewer users might find validation profitable enough—potentially reducing overall participation rates over time.

Market Volatility’s Effect on Validator Engagement

The cryptocurrency landscape is highly sensitive; sharp price swings often impact user behavior regarding staking activities:

- During bullish phases with rising ETH prices and strong market sentiment, more users are motivated by potential gains.

- Conversely, during bearish trends or high volatility episodes—such as sudden dips—they might withdraw their stakes temporarily or entirely exit until conditions stabilize.

Such fluctuations can cause short-term dips but typically do not significantly alter long-term growth trends if underlying fundamentals remain strong.

Regulatory Developments Shaping Future Participation

Regulatory clarity remains one of the most influential external factors affecting net staking rates post-Merge:

- Countries like the United States have begun clarifying rules around crypto assets which tend toward encouraging institutional involvement.

- Conversely, regulatory crackdowns or ambiguous policies could deter smaller investors from participating further into staking activities due to compliance concerns or legal uncertainties.

As governments worldwide refine their stance towards cryptocurrencies—including proposals related specifically to securities classification—the future landscape for Ethereum validators will be shaped accordingly.

Maintaining Decentralization & Economic Incentives for Sustained Growth

Ensuring that validation remains decentralized requires continuous efforts beyond just increasing numbers:

- Protocol updates should promote fair distribution among diverse participants.

- Reward structures must balance profitability with inclusivity so smaller holders can participate without disproportionate influence.

- Education campaigns can help new users understand benefits and risks associated with staking under evolving regulatory environments.

Tracking Long-Term Trends: Is Validator Participation Sustainable?

Overall data suggests that since The Merge,

- Validator counts have grown steadily,

- Initial enthusiasm has transitioned into sustained interest,

- Fluctuations driven by market dynamics are normal but do not threaten overall upward momentum,

indicating robust confidence within parts of the community about Ethereum’s future prospects under PoS governance.

Final Thoughts: What Does It Mean for Users & Investors?

For existing stakeholders considering whether they should stake their ETH—or newcomers evaluating entry points—the evolving net participation rate offers valuable insights into network health:

- A high level indicates strong community engagement,

- Growing validator numbers suggest increasing trust,

- Stability amidst volatility reflects resilience,

making it clear that despite challenges posed by external factors like regulation and market swings—all signs point toward continued maturation of Ethereum's proof-of-stake ecosystem.

References

Lo

2025-05-11 06:24

How has the net staking participation rate evolved on Ethereum (ETH) since the Merge?

How Has the Net Staking Participation Rate Evolved on Ethereum Since the Merge?

Understanding Ethereum’s Transition to Proof of Stake

Ethereum's transition from proof-of-work (PoW) to proof-of-stake (PoS), known as "The Merge," took place on September 15, 2022. This significant upgrade aimed to enhance the network’s scalability, security, and energy efficiency. Unlike PoW, which relies on miners solving complex puzzles to validate transactions, PoS depends on validators who stake their ETH tokens to participate in consensus. This shift was driven by a desire to reduce energy consumption and improve network sustainability while maintaining decentralization.

Initial Impact of The Merge on Validator Participation

Immediately following The Merge, there was a notable surge in validator activity. Many users and institutions saw staking as an attractive opportunity due to the potential for earning rewards through newly minted ETH. This initial enthusiasm led to a rapid increase in active validators—participants actively involved in validating transactions and securing the network.

This spike reflected both market optimism and confidence in Ethereum’s new consensus mechanism. Validators were incentivized not only by staking rewards but also by supporting a more sustainable blockchain infrastructure. During this period, participation rates reached high levels compared with pre-Merge figures.

Trends in Validator Growth Post-Merge

Since that initial surge, data indicates that while validator participation has stabilized somewhat, there has been consistent growth in total validator numbers over time. The number of active validators tends to fluctuate based on market conditions but generally shows an upward trend.

This steady increase suggests ongoing interest from individual investors and institutional players alike who recognize staking as a long-term opportunity within Ethereum's ecosystem. As more ETH is staked—either directly or via third-party services—the overall security of the network continues improving due to increased decentralization efforts.

Factors Influencing Staking Participation Rates

Several key factors influence how many validators participate actively:

Market Volatility: Cryptocurrency markets are inherently volatile; during downturns or periods of high fluctuation, some validators may choose temporarily or permanently exit their positions either for risk mitigation or profit-taking.

Staking Rewards: The attractiveness of staking rewards plays a crucial role; higher yields tend to encourage more participation while reductions can lead some participants to withdraw.

Regulatory Environment: Legal clarity around crypto assets impacts validator engagement significantly. Favorable regulations can boost confidence among participants; uncertainty may cause hesitation or withdrawal.

Network Security Measures: Protocol upgrades like Casper FFG aim at preventing centralization risks by incentivizing diverse validator participation across different entities.

Challenges: Centralization Risks & Economic Incentives

While increased validator numbers are positive for decentralization and security, there's always concern about centralization—where control over large portions of staked ETH could threaten network integrity. If too few entities hold significant stakes (a phenomenon called "rich-get-richer"), it could undermine Ethereum's decentralized ethos despite technical safeguards like Casper FFG designed for fairness.

Economic incentives remain vital: if staking rewards diminish due to protocol changes or market conditions such as declining ETH prices relative to fiat currencies, fewer users might find validation profitable enough—potentially reducing overall participation rates over time.

Market Volatility’s Effect on Validator Engagement

The cryptocurrency landscape is highly sensitive; sharp price swings often impact user behavior regarding staking activities:

- During bullish phases with rising ETH prices and strong market sentiment, more users are motivated by potential gains.

- Conversely, during bearish trends or high volatility episodes—such as sudden dips—they might withdraw their stakes temporarily or entirely exit until conditions stabilize.

Such fluctuations can cause short-term dips but typically do not significantly alter long-term growth trends if underlying fundamentals remain strong.

Regulatory Developments Shaping Future Participation

Regulatory clarity remains one of the most influential external factors affecting net staking rates post-Merge:

- Countries like the United States have begun clarifying rules around crypto assets which tend toward encouraging institutional involvement.

- Conversely, regulatory crackdowns or ambiguous policies could deter smaller investors from participating further into staking activities due to compliance concerns or legal uncertainties.

As governments worldwide refine their stance towards cryptocurrencies—including proposals related specifically to securities classification—the future landscape for Ethereum validators will be shaped accordingly.

Maintaining Decentralization & Economic Incentives for Sustained Growth

Ensuring that validation remains decentralized requires continuous efforts beyond just increasing numbers:

- Protocol updates should promote fair distribution among diverse participants.

- Reward structures must balance profitability with inclusivity so smaller holders can participate without disproportionate influence.

- Education campaigns can help new users understand benefits and risks associated with staking under evolving regulatory environments.

Tracking Long-Term Trends: Is Validator Participation Sustainable?

Overall data suggests that since The Merge,

- Validator counts have grown steadily,

- Initial enthusiasm has transitioned into sustained interest,

- Fluctuations driven by market dynamics are normal but do not threaten overall upward momentum,

indicating robust confidence within parts of the community about Ethereum’s future prospects under PoS governance.

Final Thoughts: What Does It Mean for Users & Investors?

For existing stakeholders considering whether they should stake their ETH—or newcomers evaluating entry points—the evolving net participation rate offers valuable insights into network health:

- A high level indicates strong community engagement,

- Growing validator numbers suggest increasing trust,

- Stability amidst volatility reflects resilience,

making it clear that despite challenges posed by external factors like regulation and market swings—all signs point toward continued maturation of Ethereum's proof-of-stake ecosystem.

References

Penafian:Berisi konten pihak ketiga. Bukan nasihat keuangan.

Lihat Syarat dan Ketentuan.

How the Beacon Chain Coordinates Validator Duties and Shard Transitions in Ethereum

Understanding how Ethereum's Beacon Chain manages validator responsibilities and facilitates shard transitions is essential for grasping the network’s ongoing evolution toward scalability and security. As part of Ethereum 2.0, the Beacon Chain introduces a new proof-of-stake (PoS) consensus mechanism that replaces traditional proof-of-work (PoW). This shift aims to make the network more sustainable, efficient, and capable of handling increased transaction volumes through sharding.

The Role of the Beacon Chain in Validator Coordination

The Beacon Chain acts as the backbone for validator management within Ethereum 2.0. Validators are responsible for proposing new blocks, validating transactions, and maintaining network security. Unlike miners in PoW systems, validators are chosen based on their staked ETH—meaning their financial commitment directly influences their chances of participating in block creation.

Validator selection is governed by a randomized process that ensures fairness while incentivizing honest participation. When selected to propose a block during a specific slot—a fixed time interval—the validator must create or validate transactions within that window. To prevent malicious activities such as double proposals or equivocation, Ethereum employs slashing mechanisms: if validators act dishonestly or fail to perform duties correctly, they risk losing part or all of their staked ETH.

The Beacon Chain organizes these activities into epochs—larger time frames composed of multiple slots (typically 32). Each epoch allows for validator rotations and updates to be processed systematically, ensuring smooth operation across the entire network.

Managing Shard Transitions for Scalability

One of Ethereum 2.0’s primary goals is scalability through sharding—a technique where the blockchain is split into smaller pieces called shards that operate concurrently. Each shard handles its own subset of transactions and smart contracts, significantly increasing overall throughput compared to a single monolithic chain.

Shard transitions involve several key steps:

- Initialization: The Beacon Chain assigns validators to different shards based on current network needs.

- Activation Phases: Shards are gradually activated through phased rollouts—initially testing shard functionality via dedicated testnets like the Shard Canary Network launched in 2023.

- Data Migration: During transition phases, data from existing chains migrates into shards seamlessly without disrupting ongoing operations.

- Cross-Linking Mechanisms: To enable communication between shards—such as transferring assets or verifying cross-shard data—the protocol implements cross-linking structures that connect individual shard chains back to the main chain.

This architecture allows multiple transactions across different shards simultaneously without bottlenecking at one point—a significant improvement over traditional blockchain models prone to congestion during high demand periods.

Recent Developments Supporting Validator Coordination & Sharding

Ethereum's recent advancements underscore its commitment toward achieving full scalability with robust security measures:

Shard Canary Network (SCN): Launched in 2023 as an experimental environment for testing shard functionalities under real-world conditions before deploying on mainnet.

Mainnet Merge: Expected late 2023 or early 2024 marks a pivotal milestone where Ethereum will combine its existing PoW mainnet with the PoS-based Beacon Chain—a process known as "the Merge." This event will fully transition validation duties onto PoS while integrating sharding features progressively afterward.

These developments demonstrate continuous progress towards decentralization and efficiency but also highlight technical challenges such as ensuring secure cross-shard communication and maintaining validator incentives throughout complex upgrades.

Challenges Facing Validator Coordination & Shard Transition

While promising, transitioning from traditional blockchain architectures involves notable hurdles:

Technical Complexity: Implementing seamless communication between numerous shards requires sophisticated protocols; any vulnerabilities could compromise security.

Validator Participation Rates: The success hinges on active validator engagement; low participation could slow down progress or cause instability.

Network Security Risks: As complexity increases with sharding—and especially during transitional phases—the attack surface expands if not properly managed.

Regulatory Uncertainty: Evolving legal frameworks around cryptocurrencies may influence adoption rates among validators and users alike.

Addressing these issues demands rigorous testing—including testnets like SCN—and community support aligned with long-term development goals.